2021 marginal brackets

The Federal Income Tax in contrast to the Illinois income tax has multiple tax brackets with varied bracket width for single or joint filers. You would both have the same marginal tax rate of 22.

How The Tcja Tax Law Affects Your Personal Finances

Ad Compare Your 2022 Tax Bracket vs.

. The remaining rates were each reduced by 0125 percentage points except for. Your 2021 Tax Bracket To See Whats Been Adjusted. Top marginal rates range from North Dakotas 29 percent to Californias 133 percent.

Page 3 of 26. Over 45142 up to 90287. Illinois income tax rates were last changed four years prior to 2020 for tax year 2016 and the tax brackets have not been changed since at least 2001.

45142 or less. At the other end of the spectrum Hawaii has 12 brackets. There are 5 tax brackets.

Heres an example. You would only have to pay a 22 rate on 19475 of your income at 60000 in taxable earnings. Illinois has a flat income tax rate which applies to both single and joint filers.

Canada - Federal 2022 and 2021 Tax Brackets and Marginal Tax Rates Income Tax Act s. Please read the article Understanding the Tables of Personal Income Tax Rates. North Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

In Ontario tax brackets are based on net income for income tax purposes. Someone who earns 80000 would pay the 22 rate on 39475 of their income in 2021 the amount over 40525 in 2021. You would both fall into the same tax bracket.

Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Discover Helpful Information And Resources On Taxes From AARP.

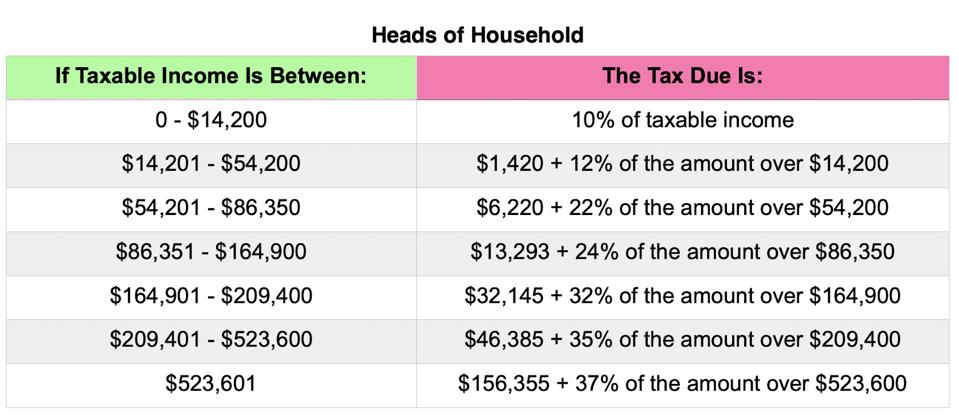

The type and rule above prints on all proofs including departmental reproduction. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and 628300 and higher for married couples filing jointly. North Carolinas maximum marginal income tax rate is the 1st highest in the United States ranking directly below North Carolinas.

The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1024 a 24 increase. 380 Idahos top marginal individual income tax rate and third-lowest rate were both eliminated.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

State Corporate Income Tax Rates And Brackets Tax Foundation

Missouri Income Tax Rate And Brackets H R Block

2022 2023 Tax Brackets Rates For Each Income Level

Here S When Married Filing Separately Makes Sense Tax Experts Say

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

2021 Tax Rate Card Moulatlet Financial

Marginal Tax Rate Formula Definition Investinganswers

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Marginal Tax Rates For Each Canadian Province Kalfa Law

Personal Income Tax Brackets Ontario 2021 Md Tax

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

New Jersey Nj Tax Rate H R Block

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How The Tcja Tax Law Affects Your Personal Finances

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor